Discover the perks👇

Are you a parent or legal guardian?

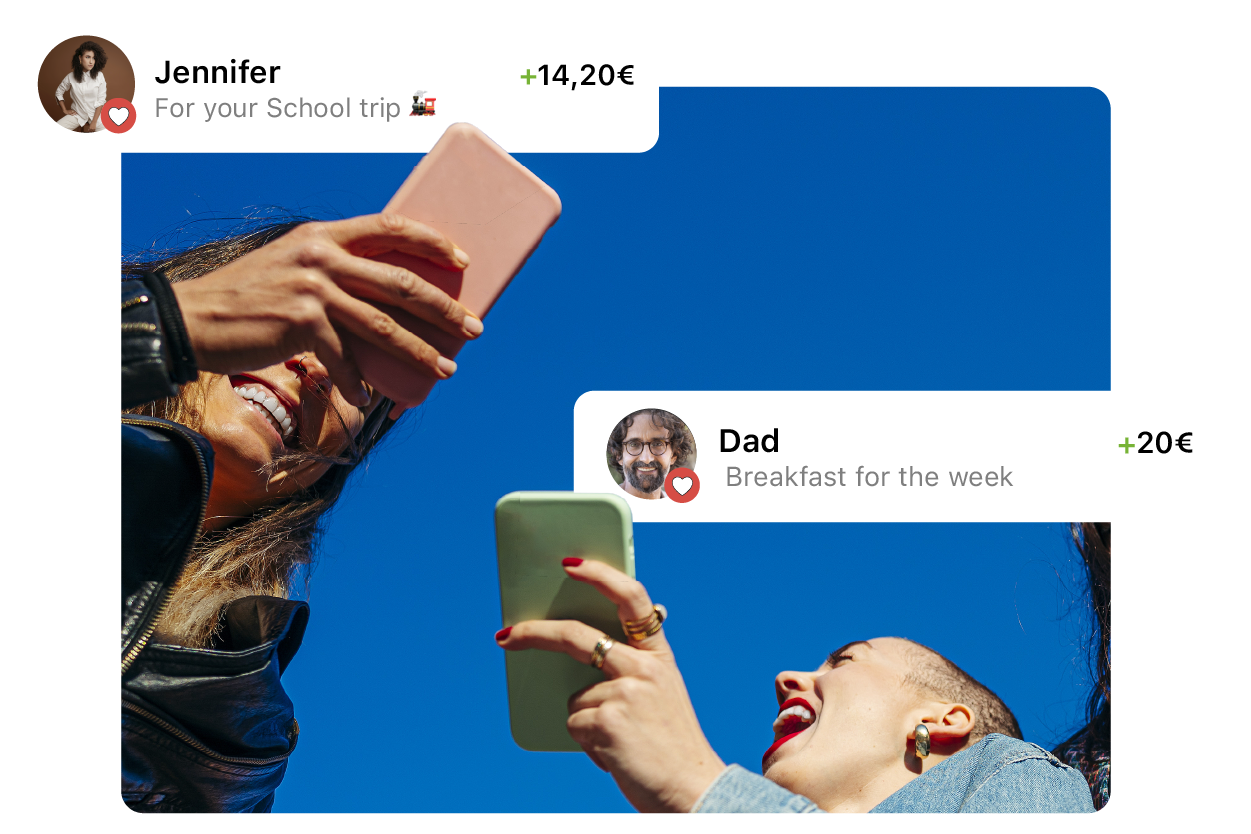

Keep up with the times (and with your kids). Start sending money directly with your smartphone to them or to your favorite stores: it will only take a few seconds.

Are you between 14 and 17 yo?

How you managed without it so far! Your smartphone will become essential: in an instant you can use your allowance and exchange money with friends.

EASY ALLOWANCE

One click. That's the time it takes for the money to reach your kids, anytime, anywhere. You can say goodbye to trips to the ATM, and with the option of recurring payments, no more forgetfulness! Quite convenient, isn't it?

INDEPENDENCE AND SECURITY

With Satispay, teenagers can independently manage pocket money and expenses directly from the app, without credit cards or prepaid cards. And security? In addition to having a spending limit, teenagers can only make purchases in selected stores, and if necessary, you can always have visibility on their transactions.

EXCHANGE MONEY WITH FRIENDS

The good news is that with the Satispay app, you can send and receive money in an instant, like splitting the pizza bill or group gifts. The bad news is that excuses like "I'll pay you later" are no longer credible.

PAY IN STORES AND ONLINE

Snacks, train tickets, or that video game you've been eyeing for a while, all at the click of a button: you won't have to search for coins at the bottom of your backpack anymore because you can purchase with your smartphone at selected stores and platforms affiliated with Satispay.

How does it work? A piece of cake:

Just download the Satispay payment app on your phone (with Android or iOS) and complete the registration

If you're between 14 and 17 years old, you'll need to enter the phone number of a parent or legal guardian

The parent or legal guardian, already a Satispay user, will approve the registration from their profile. And if they're not registered, no problem, they can sign up and follow the steps listed below

Frequently asked questions

What you need to sign up is:

- a compatible smartphone (iOS 12.0 or later / Android 6.0 or later / Huawei HarmonyOS 1.0 or later) with a working camera;

- your phone number;

- your email address;

- your ID (Passport / ID Card / Driving License);

- your Tax Code;

- your parent's or legal guardian's name, surname, telephone number and authorisation.

Follow the steps in the App to complete the registration and you will be notified in the App as soon as the verification is complete.

Your parent or legal guardian must have an active Satispay account in order to authorise you to use Satispay for Teenagers and agree to the Terms of Use for the service which they will receive via notification in the App. If they do not yet have an account, they can register by following the instructions here.

You can top up your account by receiving money from your contacts.

The money received will become your Balance and it can be spent on purchases in physical and online shops. You'll also be able to send payments from the Services section or exchange money to your friends and family from the Contacts section.

Your parent/legal guardian can also set up a recurring payment to your account: to do so simply follow the steps outlined here.

Finally, we would like to inform you that a monthly spending limit of €500 can be activated on your account. When the limit is reached, you will be notified in the App via an error message at the time of payment. This limit can be updated or changed by Satispay at any time.

Some shop types are excluded and will be displayed as disabled in the Shops section in the App.

If you try to send a payment to these shops via QR Code, you will see an error message and the transaction will not be completed.

Finally, we would like to inform you that a monthly spending limit of €500 can be activated on your account. When the limit is reached, you will be notified in the App via an error message at the time of payment. This limit can be updated or changed by Satispay at any time.

To check the transaction list of the Satispay for Teenagers account, simply contact us directly from your App or write to us at support@satispay.com. We will provide you with the information you need.

No. You can request a list of your transactions by contacting us from your App or writing to us at support@satispay.com.

As soon as you turn 18, you will be shown a notification in the App to accept the General Terms and Conditions of Use for the "Satispay Consumer" service.

If you wish, you can also add your IBAN from the Profile section by clicking on Settings > Manage IBAN.

This will allow you to set a Budget and receive top-ups, as well as transfer money from your Satispay account to your bank account and use all the services in the App.

Before proceeding with the deactivation process, we would like to remind you that if you encounter a problem using Satispay, you can contact us directly through the App Support Centre or by writing to support@satispay.com and we will certainly be able to help you.

If in any case you have decided to deactivate your Satispay account permanently, please log into the App, click on Profile > Settings > Delete account and follow the instructions.

Your parent/legal guardian can also request deactivation of your account. To do so, simply send us a specific request via the App or by writing to

support@satispay.com.

- refund of any remaining e-money by transfer to your parent/legal guardian's Satispay account;

- deactivation of the account.

If your parent/legal guardian has their account deactivated, your account will also need to be deactivated.

We’ll then proceed with the refund of any remaining e-money by transfer to your parent/legal guardian's Satispay account so that both accounts will be deactivated.

Deactivation takes a few business days and we will email you and your parent/legal guardian as soon as it is complete.